WELCOME TO PROTHROWBACKS

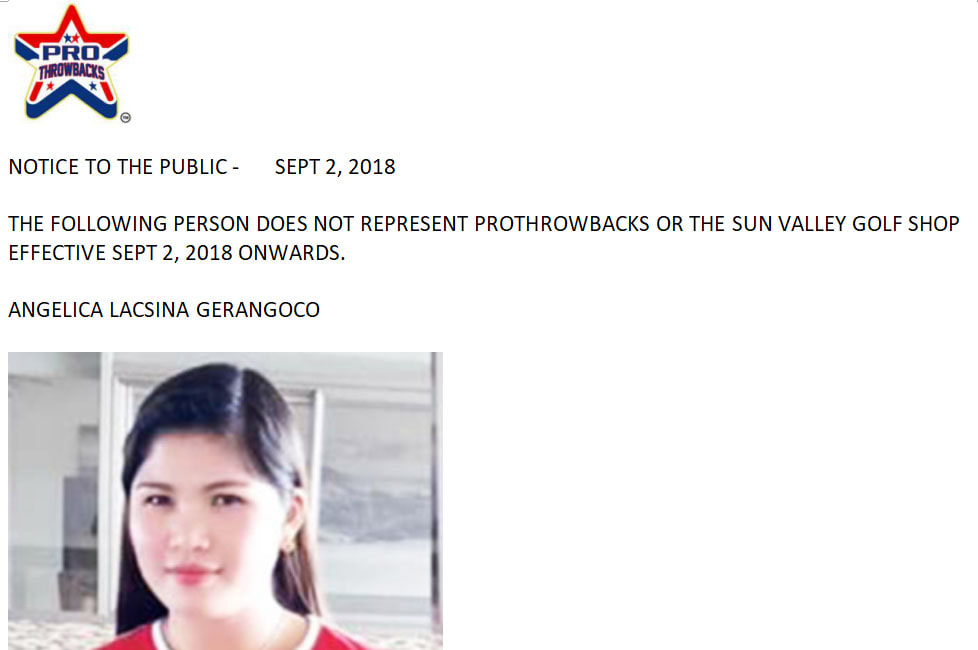

NOTIFICATION: Please do not accept Certificate of Employment from any current or previous employees unless contacting us from the form below.

Welcome to ProThrowbacks, whether you're with us as a Casual Employee, Project Employee, Probationary Employee, or Regular Employee, the following rules listed below apply. You can click here to see the current vacant postions: http://www.prothrowbacks.com/employment.html

We require each employee new and recurring to know our store policies and procedures. Each are required to read, understand, and sign acknowledgement of the policies upon initial hiring and annual review. Here's some of the most important information for new employees:

1. Take the job serious, our company will only grow with competent employees who want a future in sports, music, and collectibles; with a potential future in education and manufacturing.

2. Each new and returning (from previous resignation) employee will be given a probationary period of 6 months. During the 5th month of employment, you will be given a written test on product knowledge. The test will cover the major sports teams of the NFL, NBA, MLB, you must know each of the teams by logo and colors. Your golf test will include product brands, products, terminology, etc. Basic knowledge of collectibles will also be required. Failure to achieve a score of 50% correct will result in termination during probationary period. Scores of 75% are required for management positions and increase in daily salary. A re-take of the test will be allowed upon the request of the employee within the first six months period. The object is to assist the employee in passing and excelling the goal to finish with a high score.

In the Past, we've have three outstanding scores.

Ms. Gin - 100% correct

Ms. Chin - 99.9% correct

Sir Jun - 97% correct

Refusal to take the written test within the 5th month, ProThrowbacks will grade you at a 0% and therefore accept your immediate resignation or reschedule the test when you feel better fit to take the test.

3. In the out years ProThrowbacks may be expanding in education and manufacturing. Please take your position serious! You must be able to contribute as a team player, positive attitude, remain honest, have reasonable sales and be above reproach.

4. You must improve your knowledge on a daily basis about sports, collectibles, and music related items. We stand alone in product knowledge, team sports products, and how to play the many various sports. All the employees should feel comfortable to teach a new customer or young athlete how to play a particular sport. We have one of the largest libraries of sports in the country. You are encouraged to read, learn, and put into practice the methods of sports.

5. Staff retention is among our highest goal. The company loses money if we only hire someone for six months and then turn them loose.

Supervisory analysis is ongoing and subordinate employees should obey their supervisors on work related issues. Within the first six months of employment, the supervisory team will review the following for each employee.

a. Reliability/Dependability: Was the employee reliable, did they show up to work in a time manner and when they were expected to do so. This is our most important requirement. If you can't show up to work, you place burden on the rest of the team and therefore not a valuable asset in our workplace. If an employee has 3 unexcused absences during their first six months, they will not be an asset to the company and therefore we will accept their resignation.

b. Product Knowledge: It's hard to sell and product or service without product knowledge.

c. Presentation: Personal and Professional presentation is mandatory in working with a multitude of people. We are a wholesome business run by conservative employers. We expect all people to behave in a professional manner at all times.

d. Development of New Skills: The Management team challenges each employee to develop their knowledge, skills, and abilities as time goes on. Raises are based on new skills, overall sales, and willing to work with others.

e. Cleanliness: Ability to constantly keep areas of responsibility clean and orderly to the public. Not too many people enjoy cleaning, but it has to be done.

f. Sales: Our min. sales ratio per daily rate is seven times your daily/annual salary (plus benefits)

g. Honesty. Ensuring all funds, products, are secure. No misuse of funds, fraud, or theft will be tolerated.

h. Cyber Conduct. While employed with ProThrowbacks, you must behave in a professional manner at all times, which includes statements that you make online in various sources or mediums.

Hours of Operations 10-7 Daily. Managers are Responsible for Opening and Closing of the Stores. We do not turn off the lights until 7pm, in which time, the sales assistants my go home. Store Managers can finish the end of the day requirements. Everyone else can go home.

ProThrowbacks Top Employment Priorities

- Honor GOD in all that you do!

- Safety of Employees and Customers

- Security of Products and Funds

- Outstanding Customer Service

- Constantly Self-Improvement of Product Knowledge

- Honesty and Integrity

- Commitment to Work

- Be enthusiastic, positive, and have a cheerful spirit at work

- Superviors are to be fair, reasonable, and understanding

- Teach new employees to grow.

SAFETY IS OUR NUMBER ONE POLICY

If someone is injured or became ill from work, the VP or Managers must download the following form, fill out and turn in during the annual Department of Labor Report, the lin can be found here.

http://bwc.dole.gov.ph/userfiles/file/WAIR.PDF Safety rules and guidelines. To ensure your safety, and that of your co-workers, please observe and obey the rules and guidelines appropriate to the general populace or specific jobs:

Safety shoes: The organization will designate which jobs and work areas require safety shoes. Under no circumstances will an employee be permitted to work in sandals or open-toe shoes. A reliable safety shoe vendor will visit the entity periodically. Notices will be posted prior to the visits.

Safety glasses: The wearing of safety glasses by all shop employees and volunteers is mandatory while using the buffing machine to clean golf clubs. Strict adherence to this policy can significantly reduce the risk of eye injuries.

Seat belts: All paid and volunteer staff must use seat belts and shoulder restraints (if available) whenever they operate a vehicle on organization business. The driver is responsible for seeing that all passengers in front and rear seats are buckled up.

Good housekeeping: Your work location should be kept clean and orderly. Keep machines and other objects (merchandise, boxes, shopping carts, etc.) out of the center of aisles. Clean up spills, drips, and leaks immediately to avoid slips and falls. Place trash in the proper receptacles. Stock shelves carefully so merchandise will not fall over upon contact.

Thanks to nonprofitrisk for these fantastic safety tips.

If someone is injured or became ill from work, the VP or Managers must download the following form, fill out and turn in during the annual Department of Labor Report, the lin can be found here.

http://bwc.dole.gov.ph/userfiles/file/WAIR.PDF Safety rules and guidelines. To ensure your safety, and that of your co-workers, please observe and obey the rules and guidelines appropriate to the general populace or specific jobs:

- Observe and practice the safety procedures established for the job.

- In case of sickness or injury, no matter how slight, report at once to your supervisor. In no case should an employee treat his or her own or someone else’s injuries or attempt to remove foreign particles from someone else’s eye.

- In case of injury resulting in possible fracture to legs, back, or neck, or any accident resulting in an unconscious condition, or a severe head injury, the employee is not to be moved until medical attention has been given by authorized personnel.

- Do not wear loose clothing or jewelry around machinery. It may catch on moving equipment and cause a serious injury.

- Never distract the attention of another person, as you might cause him or her to be injured. If necessary to get the attention of another person, wait until it can be done safely.

- Where required, you must wear protective equipment, such as goggles, safety glasses, masks, gloves, hair nets, etc. appropriate to the task.

- Safety equipment such as restraints, pull backs, and two-hand devices are designed for your protection. Be sure such equipment is adjusted for you.

- Pile materials, skids, bins, boxes, or other equipment so as not to block aisles, exits, fire fighting equipment, electric lighting or power panel, valves, etc. Fire Doors and Aisles Must be Kept Clear!

- Keep your work area clean.

- Use compressed air only for the job for which it is intended. Do not clean your clothes with it, and do not fool around with it.

- Observe “No Smoking” regulations.

- Shut down your machine before cleaning, repairing, or leaving it.

- Do not exceed a speed that is safe for existing conditions.

- Running and horseplay are strictly forbidden.

- Do not block access to fire extinguishers.

- Do not tamper with electric controls or switches.

- Do not operate machines or equipment until you have been properly instructed and authorized to do so by your supervisor. Ensure the proper voltage is identified on each plug, i.e. 110v and 220v.

- Do not engage in such other practices as may be inconsistent with ordinary and reasonable common sense safety rules.

- Report any unsafe condition or acts to your supervisor and make all necessary changes on the spot until you identify the problem to your supervisor.

- Help to prevent accidents.

- Never throw a ball at someone without ensuring they are ready and watching for the ball.

- Use designated passages when moving from one place to another; never take hazardous shortcuts (i.e., between moving equipment or across roadways).

- Lift properly—use your leg muscles, not your back muscles. For heavier loads, ask for assistance.

- Do not adjust, clean, or oil moving machinery.

- Keep machine guards in their intended places.

- Do not throw objects not meant to be thrown.

- Clean up spilled liquid, oil, or grease immediately.

- Wear hard-sole shoes, with covered toes and appropriate clothing (no open toes shoes).

- Place trash and paper in proper containers and not in cans provided for cigarette butts.

- Slippery floors and walkways

- Tripping hazards, such as hose links, piping, etc.

- Missing (or inoperative) entrance and exit signs and lighting

- Poorly lighted stairs

- Loose handrails or guard rails

- Open, loose or broken windows

- Dangerously piled supplies or equipment

- Unlocked doors and gates

- Electrical equipment left operating

- Open doors on electrical panels

- Leaks of steam, water, oil, other liquids

- Blocked aisles

- Blocked fire extinguishers, hose sprinkler heads

- Blocked fire doors

- Evidence of any equipment running hot or overheating

- Oily rags

- Evidence of smoking in non-smoking areas (like outside our Music and Bike Store) DO NOT ALLOW CUSTOMERS OR EMPLOYEES TO SMOKE IN THIS AREA. WHICH ALSO GOES WITH OUR NO-SMOKING POLICY FOR ALL EMPLOYEES

- Roof leaks - Report all in writing to the PG Management team. We have had lots of product damage in the past because the PG team could not fix the leaks.

- Directional or warning signs not in place.

- Safety devices not operating properly.

- Machine, power transmission, or drive guards missing, damaged, loose, or improperly placed

Safety shoes: The organization will designate which jobs and work areas require safety shoes. Under no circumstances will an employee be permitted to work in sandals or open-toe shoes. A reliable safety shoe vendor will visit the entity periodically. Notices will be posted prior to the visits.

Safety glasses: The wearing of safety glasses by all shop employees and volunteers is mandatory while using the buffing machine to clean golf clubs. Strict adherence to this policy can significantly reduce the risk of eye injuries.

Seat belts: All paid and volunteer staff must use seat belts and shoulder restraints (if available) whenever they operate a vehicle on organization business. The driver is responsible for seeing that all passengers in front and rear seats are buckled up.

Good housekeeping: Your work location should be kept clean and orderly. Keep machines and other objects (merchandise, boxes, shopping carts, etc.) out of the center of aisles. Clean up spills, drips, and leaks immediately to avoid slips and falls. Place trash in the proper receptacles. Stock shelves carefully so merchandise will not fall over upon contact.

Thanks to nonprofitrisk for these fantastic safety tips.

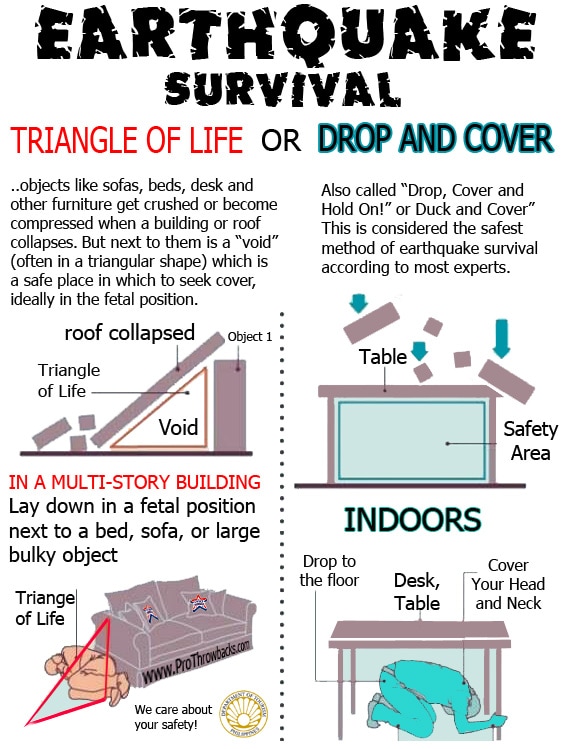

On April 17, 2017, DOT called our office to ensure that we post information regarding earthquakes for both our employees and customers.

POLICIES THAT WE MUST ABIDE BY:

ProThrowbacks is a family business, we enjoy working side by side with family members. Other employees are treated with the same respect as family members and are treated as such in many ways. However, Pure Gold has very strict policies regarding family members and those having relationships with people working in the same building. Simply put, its prohibited! So, with this potential conflict, all non-approved in advance relationships shall be approved in advance by ProThrowbacks if both employees work for ProThrowbacks. In the case that one employee works for Pure Gold and one works for ProThrowbacks, Pure Gold will make the final ruling on such decision. We reserve the right to keep in-house our trade secrets. It is also against our policy to engage with a serious relationship with a similar competitor or disclose any our suppliers to other people.

We encourage openness about the relationship - Employees should be assured that they will suffer no reprisals for choosing to date each other. However, they should also be told that in exchange for this assurance, the employer expects them to be up-front and honest about their relationships. Employees should be encouraged to inform their supervisors when they begin romantic relationships with fellow workers and be assured that such information will be kept strictly confidential.

Supervisors from Dating Direct Subordinates - Supervisors are strictly prohibited from dating any subordinate who works directly for them. Employers should, therefore, require the senior employee involved in such a relationship to report it to the Vice President of the Director of Personnel. If such a relationship is not reported and the owner nonetheless learns of it, the senior employee will be discharged. Where such a relationship is reported, and the employees involved state that they desire to continue in the relationship, the subordinate employee could be reassigned to a different supervisor.

In the past, we have more than one female employee who may have fell victim to deception from male customers. Those customers who wanted to get close to our staff members to henceforth receive favors such as hidden discounts or even manipulated prices for products. If you're are dating a customer, we need to know about the circumstances. Several attempt to illegally recruit our employees for overseas employment, in all cases, you are to report such situations so we can advise you accordingly. There is a strict law regarding this, please read the definition:

Section 3. Section 3 of Republic Act No. 9208 is hereby amended to read as follows:

"SEC. 3. Definition of Terms. – As used in this Act:

"(a) Trafficking in Persons – refers to the recruitment, obtaining, hiring, providing, offering, transportation, transfer, maintaining, harboring, or receipt of persons with or without the victim’s consent or knowledge, within or across national borders by means of threat, or use of force, or other forms of coercion, abduction, fraud, deception, abuse of power or of position, taking advantage of the vulnerability of the person, or, the giving or receiving of payments or benefits to achieve the consent of a person having control over another person for the purpose of exploitation which includes at a minimum, the exploitation or the prostitution of others or other forms of sexual exploitation, forced labor or services, slavery, servitude or the removal or sale of organs.

This is for your safety, we want to help in all situations, so please contact us before you make any final decisions. We have to respect the PG mall management team since they have many years of experience with relationships in the work place and over 300 locations country-wide.

ProThrowbacks is a family business, we enjoy working side by side with family members. Other employees are treated with the same respect as family members and are treated as such in many ways. However, Pure Gold has very strict policies regarding family members and those having relationships with people working in the same building. Simply put, its prohibited! So, with this potential conflict, all non-approved in advance relationships shall be approved in advance by ProThrowbacks if both employees work for ProThrowbacks. In the case that one employee works for Pure Gold and one works for ProThrowbacks, Pure Gold will make the final ruling on such decision. We reserve the right to keep in-house our trade secrets. It is also against our policy to engage with a serious relationship with a similar competitor or disclose any our suppliers to other people.

We encourage openness about the relationship - Employees should be assured that they will suffer no reprisals for choosing to date each other. However, they should also be told that in exchange for this assurance, the employer expects them to be up-front and honest about their relationships. Employees should be encouraged to inform their supervisors when they begin romantic relationships with fellow workers and be assured that such information will be kept strictly confidential.

Supervisors from Dating Direct Subordinates - Supervisors are strictly prohibited from dating any subordinate who works directly for them. Employers should, therefore, require the senior employee involved in such a relationship to report it to the Vice President of the Director of Personnel. If such a relationship is not reported and the owner nonetheless learns of it, the senior employee will be discharged. Where such a relationship is reported, and the employees involved state that they desire to continue in the relationship, the subordinate employee could be reassigned to a different supervisor.

In the past, we have more than one female employee who may have fell victim to deception from male customers. Those customers who wanted to get close to our staff members to henceforth receive favors such as hidden discounts or even manipulated prices for products. If you're are dating a customer, we need to know about the circumstances. Several attempt to illegally recruit our employees for overseas employment, in all cases, you are to report such situations so we can advise you accordingly. There is a strict law regarding this, please read the definition:

Section 3. Section 3 of Republic Act No. 9208 is hereby amended to read as follows:

"SEC. 3. Definition of Terms. – As used in this Act:

"(a) Trafficking in Persons – refers to the recruitment, obtaining, hiring, providing, offering, transportation, transfer, maintaining, harboring, or receipt of persons with or without the victim’s consent or knowledge, within or across national borders by means of threat, or use of force, or other forms of coercion, abduction, fraud, deception, abuse of power or of position, taking advantage of the vulnerability of the person, or, the giving or receiving of payments or benefits to achieve the consent of a person having control over another person for the purpose of exploitation which includes at a minimum, the exploitation or the prostitution of others or other forms of sexual exploitation, forced labor or services, slavery, servitude or the removal or sale of organs.

This is for your safety, we want to help in all situations, so please contact us before you make any final decisions. We have to respect the PG mall management team since they have many years of experience with relationships in the work place and over 300 locations country-wide.

ProThrowbacks Policy - Difficult Customers:

In the past, we had a situation where four golfers came to the store and they began flashing money to an employee to get the employee to reduce the price of golf clubs. A price so low, that it was offensive to the staff and ownership. The customers began to grab more and more clubs like they owned the store and started offering more discounts just to buy something cheap. The customers then became rude to one or more of the staff.

ProThrowbacks policy is very clear, employees have to be polite and helpful to customers, but they don’t have to tolerate unwelcome flirtation, verbal abuse, or physical injury. Deciding when a particular customer’s obnoxious behavior crosses the line is up to the employee, once an employee feels that way, notify the manager and the owner immediately. If it warrants, please call the security at the front door, report the incident, have the customer removed until ProThrowbacks owner arrives.

ProThrowbacks owner and management will not tolerate such behavior by any customer who insults or harasses any employee or complains about prices or products. We do not force people to buy anything, our store is there for a convenience to the customers who are looking for the products we carry.

The best advise we can give, the moment an employee feels they are having a difficult time with any customer, simply refer them to the manager of the store and walk away totally from the situation and call the owner immediately to report what happened. ProThrowbacks ownership will get involved and take immediate action to solve the problem but we have to be informed. We never place the sale of an item, from any customer, over the feelings or welfare of our employees.

This shall be placed in the employees handbook so all can read and understand our policy in this matter.

In the past, we had a situation where four golfers came to the store and they began flashing money to an employee to get the employee to reduce the price of golf clubs. A price so low, that it was offensive to the staff and ownership. The customers began to grab more and more clubs like they owned the store and started offering more discounts just to buy something cheap. The customers then became rude to one or more of the staff.

ProThrowbacks policy is very clear, employees have to be polite and helpful to customers, but they don’t have to tolerate unwelcome flirtation, verbal abuse, or physical injury. Deciding when a particular customer’s obnoxious behavior crosses the line is up to the employee, once an employee feels that way, notify the manager and the owner immediately. If it warrants, please call the security at the front door, report the incident, have the customer removed until ProThrowbacks owner arrives.

ProThrowbacks owner and management will not tolerate such behavior by any customer who insults or harasses any employee or complains about prices or products. We do not force people to buy anything, our store is there for a convenience to the customers who are looking for the products we carry.

The best advise we can give, the moment an employee feels they are having a difficult time with any customer, simply refer them to the manager of the store and walk away totally from the situation and call the owner immediately to report what happened. ProThrowbacks ownership will get involved and take immediate action to solve the problem but we have to be informed. We never place the sale of an item, from any customer, over the feelings or welfare of our employees.

This shall be placed in the employees handbook so all can read and understand our policy in this matter.

PROTHROWBACKS POLICY ON ABSENTEEISM

Working at ProThrowbacks and being a part of the sports industry requires that employees must be physically and mentally fit for work. To strive to eliminate discharging employees for excessive and chronic absenteeism, which can be interpreted as misconduct when the absences are without justifiable cause or untimely notification to the employer.

All employees whether late or absent shall contact the office before the schedule time of work so that ProThrowbacks can adjust their work schedule accordingly. A minimum of two hours prior to the work schedule, but it is preferred the day before or whenever the illness occurs so the staff has ample time to get a replacement. If you can't contact your supervisor with a live conversation (no text message), then try to arrange someone to cover your shift.

ProThrowbacks requires all employees proof of illness of three days or more of being absent from work. A doctor release is also required prior to their return to work if they miss three consecutive days of work.

When employees require assistance through Phil Health. Please contact the office so we can begin to process the papers needed for the overnight hospitalization.

ProThrowbacks does not tolerate anyone who is dependent or use illegal drugs or alcohol which prevents them to come to work. Anyone caught during their work time will be terminated for just cause and they will be reported to the local authorities.

In theory, give everyone the common courtesy to cover for your job while you're absent. Employees who do not comply may be suspended without pay up to and including termination.

The "Director of Personnel" or the "Vice President" is the responsible to ensure that all employees show up to work on time and keep accurate time keep records.

Absenteeism Due to Ingested Substances:

The following behavior patterns by any staff or management will not be tolerated:

a. Administer – any act of introducing any dangerous drug into the body of any person, with or without his/her knowledge, by injection, inhalation, ingestion or other means, or of committing any act of indispensable assistance to a person in administering a dangerous drug to himself/herself unless administered by a duly licensed practitioner for purposes of medication; or use any act of injecting, intravenously or intramuscularly, of consuming, either by chewing, smoking, sniffing, eating, swallowing, drinking or otherwise introducing into the physiological system of the body, any of the dangerous drugs.

b. Dangerous Drugs - include those listed in the Schedules annexed to the 1961 Single Convention on Narcotic Drugs, as amended by the 1972 Protocol, and in the Schedules annexed to the 1971 Single Convention on Psychotropic Substances.

c. Instrument – any thing that is used or intended to be used, in any manner, in the commission of illegal drug trafficking or related offenses;

d. Near Miss – an incident arising from or in the course of work which could have led to injuries or fatalities of the workers and/or considerable damage to the employer had it not been curtailed.

e. Sell/Sale – Any act of giving away any dangerous drug and/or controlled precursor and essential chemical whether for money or any other consideration.

ProThrowbacks Director of Personnel will:

a. Lead an Assessment Team – will be composed of the CDC safety and health committee including occupational safety and health personnel, CDC human resources managers, employers and workers’ representatives trained to address all aspects of prevention, treatment and rehabilitation.

b. Conduct Prevention Training – Organize the promotion of a drug-free lifestyle thru strategies such as advocacy, information dissemination, and capability building through training.

c. Conduct Screening Test – Oversea a rapid test performed to establish potential/presumptive positive result. It refers to the immunoassay test to eliminate a “negative” specimen, i.e. one without the presence of dangerous drugs, from further consideration and to identify the presumptively positive specimen that requires confirmatory test. The Director of Personnel shall consider Random Drug Test – by testing each employee. Each should have an equal chance of being selected for testing. The policy on the conduct of random drug test will be known to both employers and employees and under supervision.

ProThrowbacks reward system. Starting Jan 1 until Dec 31, each employee that has perfect absentee record will receive P1,000 for each year that the record remains in tact. Payment made at the end of year during the Christmas Party.

Feedback regarding this policy can be sent via email through our website. This policy is in effective Sept 22, 2012 on the date of this signing.

Working at ProThrowbacks and being a part of the sports industry requires that employees must be physically and mentally fit for work. To strive to eliminate discharging employees for excessive and chronic absenteeism, which can be interpreted as misconduct when the absences are without justifiable cause or untimely notification to the employer.

All employees whether late or absent shall contact the office before the schedule time of work so that ProThrowbacks can adjust their work schedule accordingly. A minimum of two hours prior to the work schedule, but it is preferred the day before or whenever the illness occurs so the staff has ample time to get a replacement. If you can't contact your supervisor with a live conversation (no text message), then try to arrange someone to cover your shift.

ProThrowbacks requires all employees proof of illness of three days or more of being absent from work. A doctor release is also required prior to their return to work if they miss three consecutive days of work.

When employees require assistance through Phil Health. Please contact the office so we can begin to process the papers needed for the overnight hospitalization.

ProThrowbacks does not tolerate anyone who is dependent or use illegal drugs or alcohol which prevents them to come to work. Anyone caught during their work time will be terminated for just cause and they will be reported to the local authorities.

In theory, give everyone the common courtesy to cover for your job while you're absent. Employees who do not comply may be suspended without pay up to and including termination.

The "Director of Personnel" or the "Vice President" is the responsible to ensure that all employees show up to work on time and keep accurate time keep records.

Absenteeism Due to Ingested Substances:

The following behavior patterns by any staff or management will not be tolerated:

a. Administer – any act of introducing any dangerous drug into the body of any person, with or without his/her knowledge, by injection, inhalation, ingestion or other means, or of committing any act of indispensable assistance to a person in administering a dangerous drug to himself/herself unless administered by a duly licensed practitioner for purposes of medication; or use any act of injecting, intravenously or intramuscularly, of consuming, either by chewing, smoking, sniffing, eating, swallowing, drinking or otherwise introducing into the physiological system of the body, any of the dangerous drugs.

b. Dangerous Drugs - include those listed in the Schedules annexed to the 1961 Single Convention on Narcotic Drugs, as amended by the 1972 Protocol, and in the Schedules annexed to the 1971 Single Convention on Psychotropic Substances.

c. Instrument – any thing that is used or intended to be used, in any manner, in the commission of illegal drug trafficking or related offenses;

d. Near Miss – an incident arising from or in the course of work which could have led to injuries or fatalities of the workers and/or considerable damage to the employer had it not been curtailed.

e. Sell/Sale – Any act of giving away any dangerous drug and/or controlled precursor and essential chemical whether for money or any other consideration.

ProThrowbacks Director of Personnel will:

a. Lead an Assessment Team – will be composed of the CDC safety and health committee including occupational safety and health personnel, CDC human resources managers, employers and workers’ representatives trained to address all aspects of prevention, treatment and rehabilitation.

b. Conduct Prevention Training – Organize the promotion of a drug-free lifestyle thru strategies such as advocacy, information dissemination, and capability building through training.

c. Conduct Screening Test – Oversea a rapid test performed to establish potential/presumptive positive result. It refers to the immunoassay test to eliminate a “negative” specimen, i.e. one without the presence of dangerous drugs, from further consideration and to identify the presumptively positive specimen that requires confirmatory test. The Director of Personnel shall consider Random Drug Test – by testing each employee. Each should have an equal chance of being selected for testing. The policy on the conduct of random drug test will be known to both employers and employees and under supervision.

ProThrowbacks reward system. Starting Jan 1 until Dec 31, each employee that has perfect absentee record will receive P1,000 for each year that the record remains in tact. Payment made at the end of year during the Christmas Party.

Feedback regarding this policy can be sent via email through our website. This policy is in effective Sept 22, 2012 on the date of this signing.

Sexual Harrassment Policy

In accordance with the attached Republic Act 7877, Anti-Sexual Harassment Act of 1995

ProThrowbacks concurs with the policy set forth and thereby enforces the following:

If you are being harassed:

1. Tell the harasser that their behavior is unwelcome and ask them to stop.

2. Keep a record of incidents (date, times, locations, possible witnesses, what happened, your response). You do not have to have a record of events in order to make a complaint, but a record can strengthen your case and help you remember details over time.

3. Make a complaint. If, after asking the harasser to stop their behavior, the harassment continues, report the problem to one of the following individuals:

a) Director of Personnel

b) CEO

c) Owner, ProThrowbacks

Dealing with a complaint:

1. Once a complaint is received, it will be kept strictly confidential. An investigation will be undertaken immediately and all necessary steps taken to resolve the problem. If appropriate, action taken may include conciliation.

2. Both the complainant and the alleged harasser will be interviewed, as will any individuals who may be able to provide relevant information. All information will be kept in confidence.

3. If the investigation reveals evidence to support the complaint of harassment, the harasser will be disciplined appropriately. Discipline may include suspension or dismissal, and the incident will be documented in the harasser’s file. No documentation will be placed on the complainant’s file when the complaint has been made in good faith, whether the complaint has been upheld oyr not.

4. If the investigation fails to find evidence to support the complaint, there will be no documentation concerning the complaint placed in the file of the alleged harasser.

5. Regardless of the outcome of a harassment complaint made in good faith, the employee lodging the complaint, as well as anyone providing information, will be protected from any form of retaliation by either co‑workers or superiors. This includes dismissal, demotion, unwanted transfer, denial of opportunities within the company or harassment of an individual as a result of their having made a complaint or having provided evidence regarding the complaint.

It is the responsibility of the Director of Personnel, Managers, or any person within this company who supervises one or more employees to take immediate and appropriate action to report or deal with incidents of harassment of any type, whether brought to their attention or personally observed. Under no circumstances should a legitimate complaint be dismissed or downplayed nor should the complainant be told to deal with it personally.

ProThrowbacks seeks to provide a safe, healthy and rewarding work environment for its employees. Harassment will not be tolerated within this company. If you feel that you are being harassed, contact us. We want to hear from you.

This Policy shall take place effective immediately and shall be made known to every employee.

In effect Jan 7, 2014.

In accordance with the attached Republic Act 7877, Anti-Sexual Harassment Act of 1995

ProThrowbacks concurs with the policy set forth and thereby enforces the following:

If you are being harassed:

1. Tell the harasser that their behavior is unwelcome and ask them to stop.

2. Keep a record of incidents (date, times, locations, possible witnesses, what happened, your response). You do not have to have a record of events in order to make a complaint, but a record can strengthen your case and help you remember details over time.

3. Make a complaint. If, after asking the harasser to stop their behavior, the harassment continues, report the problem to one of the following individuals:

a) Director of Personnel

b) CEO

c) Owner, ProThrowbacks

Dealing with a complaint:

1. Once a complaint is received, it will be kept strictly confidential. An investigation will be undertaken immediately and all necessary steps taken to resolve the problem. If appropriate, action taken may include conciliation.

2. Both the complainant and the alleged harasser will be interviewed, as will any individuals who may be able to provide relevant information. All information will be kept in confidence.

3. If the investigation reveals evidence to support the complaint of harassment, the harasser will be disciplined appropriately. Discipline may include suspension or dismissal, and the incident will be documented in the harasser’s file. No documentation will be placed on the complainant’s file when the complaint has been made in good faith, whether the complaint has been upheld oyr not.

4. If the investigation fails to find evidence to support the complaint, there will be no documentation concerning the complaint placed in the file of the alleged harasser.

5. Regardless of the outcome of a harassment complaint made in good faith, the employee lodging the complaint, as well as anyone providing information, will be protected from any form of retaliation by either co‑workers or superiors. This includes dismissal, demotion, unwanted transfer, denial of opportunities within the company or harassment of an individual as a result of their having made a complaint or having provided evidence regarding the complaint.

It is the responsibility of the Director of Personnel, Managers, or any person within this company who supervises one or more employees to take immediate and appropriate action to report or deal with incidents of harassment of any type, whether brought to their attention or personally observed. Under no circumstances should a legitimate complaint be dismissed or downplayed nor should the complainant be told to deal with it personally.

ProThrowbacks seeks to provide a safe, healthy and rewarding work environment for its employees. Harassment will not be tolerated within this company. If you feel that you are being harassed, contact us. We want to hear from you.

This Policy shall take place effective immediately and shall be made known to every employee.

In effect Jan 7, 2014.

Daily Work Schedule

Show up to work on-time, notify the Vice President immiedately if you are going to be late for work so they can call the building supervisor. An employee who falsifies time worked is considered stealing from the employer. This type of fraud can cost a company considerable amounts of money if it is undetected for a long time. Falsifying time-in is punishable by immediate termination and is subject to litigation at the employer's discretion. Employers can use several techniques to monitor employees and prevent further problems. The techniques are also effective if the employer wants to get conclusive evidence of fraud before taking action. Since we're a family based business, we go by the honor system.

Show up to work on-time, notify the Vice President immiedately if you are going to be late for work so they can call the building supervisor. An employee who falsifies time worked is considered stealing from the employer. This type of fraud can cost a company considerable amounts of money if it is undetected for a long time. Falsifying time-in is punishable by immediate termination and is subject to litigation at the employer's discretion. Employers can use several techniques to monitor employees and prevent further problems. The techniques are also effective if the employer wants to get conclusive evidence of fraud before taking action. Since we're a family based business, we go by the honor system.

Store Managers - Securing Funds/Property

Each Store Manager should have in place cash handling polcies and mechanisms to prevent from loss. In the stores located in the PG Mall, there are two areas of payment. All payments must accompany a receipt with each and every product. All item numbers shall be indicated on the receipt book with the selling price. Only the VP and CEO will have access to the original purchasing power and inventory numbers. Any employee tampering with item numbers in any way, shall responsible for losses of those products. We have witnessed in the past, customers who want to change the price to a lower price. We have also witness employees who keep part of the sales (stealing) and switching prices to benefit their friends who pretend to be customers. Small discounts can be given under the approval of the manager or head office. The 001 store shall security the daily sales in an unspecified area known only to the management.

006 store sells shall be secured in the 001 area. At the Golf Course Pro Shop, once funds are received, they must be immediately turned into the main cashier at the golf course counter. We do not hold the funds for any reason at any time. This policy has been in effect by the Sun Valley Management Team since day 1 at golf course on Oct 2013 and should be applied until further notice. We do not keep, or collect money at the golf course, we are concessionaires there. All the money goes to the front counter. We only receive the funds 10 days after the last day of the month, after the golf course takes out their share.

Each Store Manager should have in place cash handling polcies and mechanisms to prevent from loss. In the stores located in the PG Mall, there are two areas of payment. All payments must accompany a receipt with each and every product. All item numbers shall be indicated on the receipt book with the selling price. Only the VP and CEO will have access to the original purchasing power and inventory numbers. Any employee tampering with item numbers in any way, shall responsible for losses of those products. We have witnessed in the past, customers who want to change the price to a lower price. We have also witness employees who keep part of the sales (stealing) and switching prices to benefit their friends who pretend to be customers. Small discounts can be given under the approval of the manager or head office. The 001 store shall security the daily sales in an unspecified area known only to the management.

006 store sells shall be secured in the 001 area. At the Golf Course Pro Shop, once funds are received, they must be immediately turned into the main cashier at the golf course counter. We do not hold the funds for any reason at any time. This policy has been in effect by the Sun Valley Management Team since day 1 at golf course on Oct 2013 and should be applied until further notice. We do not keep, or collect money at the golf course, we are concessionaires there. All the money goes to the front counter. We only receive the funds 10 days after the last day of the month, after the golf course takes out their share.

CCTV STORE POLICIES:

Our Store CCTV policy: In accordance with the National Privacy Commission:

NPC #2020-04 and the local LGU CDC requirement to have CCTV cameras in all facilities, the following applies policies in regards to our rights to protect the assets, reputation, of our company assets. We have placed numerous cameras throughout the store. To this end, we may monitor, through CCTVs, the premises and employees’. Employees will not lose their privacy rights! Personal data of the employees shall only be collected, used, and stored by the employer, through CCTV monitoring, if the purpose sought to be achieved cannot be fulfilled by any other less privacy intrusive means. As a customer or employee, by entering this store, you have waived your rights to be monitored.

Our Store CCTV policy: In accordance with the National Privacy Commission:

NPC #2020-04 and the local LGU CDC requirement to have CCTV cameras in all facilities, the following applies policies in regards to our rights to protect the assets, reputation, of our company assets. We have placed numerous cameras throughout the store. To this end, we may monitor, through CCTVs, the premises and employees’. Employees will not lose their privacy rights! Personal data of the employees shall only be collected, used, and stored by the employer, through CCTV monitoring, if the purpose sought to be achieved cannot be fulfilled by any other less privacy intrusive means. As a customer or employee, by entering this store, you have waived your rights to be monitored.

HIV and AIDS Prevention and Control in the workplace Program

HIV/AIDS WORKPLACE POLICY AND PROGRAM

In conformity with Republic Act No. 8504 otherwise known as the Philippine AIDS Prevention and Control Act of 1998 which recognizes workplace-based programs as a potent tool in addressing HIV/AIDS as an international pandemic problem, this company policy is hereby issued for the information and guidance of the employees in the diagnosis, treatment and prevention of HIV/AIDS in the workplace.

This policy is also aimed at addressing the stigma attached to HIV/AIDS and ensures that the workers’ right against discrimination and confidentiality is maintained.

I. IMPLEMENTING STRUCTURE

ProThrowbacks HIV/AIDS Program shall be managed by its health and safety committee consists of representatives from the different divisions and departments.

II. BASIC INFORMATION ON HIV/AIDS

What is HIV/AIDS?

It is a disease caused by a virus called HIV (Human Immunodeficiency Virus). This virus slowly weakens a person’s ability to fight off other diseases by attaching itself to and destroying important cells that control and support the human immune system.

How HIV/AIDS is transmitted?

No. However, there are antiretroviral drug combinations that are available when properly used, result in prolonged survival of people with HIV. Holistic care of people living with HIV-AIDS and comprehensive treatment of opportunistic infections also dramatically improve quality of life.

III. COVERAGE

This Program shall apply to all employees regardless of their employment status.

IV. GUIDELINES

A. Preventive Strategies

2. Screening, Diagnosis, Treatment and Referral to Health Care Services

A. Employer’s Responsibilities

B. Employees’ Responsibilities

1. The employee’s organization shall undertake an active role in educating and training their members on HIV prevention and control. Promote and practice a healthy lifestyle with emphasis on avoiding high risk behavior and other risk factors that expose workers to increased risk of HIV infection.

2. Employees shall practice non-discriminatory acts against co-employees.

V. IMPLEMENTATION AND MONITORING

The Safety and Health Committee or its counterpart shall periodically monitor and evaluate the implementation of this Policy and Program.

VI. EFFECTIVITY

This Policy shall take place effective immediately and shall be made known to every employee.

Original Signed

MRS. ROSEN C. HARVISON, OWNER

Original Signed

RUTCHE MAE NOBLE, V.P. OPERATIONS

First aid practices and ‘universal precautions’ within the workplace should be highlighted

This Policy shall take place effective immediately and shall be made known to every employee.

In effect Feb 6, 2015.

HIV/AIDS WORKPLACE POLICY AND PROGRAM

In conformity with Republic Act No. 8504 otherwise known as the Philippine AIDS Prevention and Control Act of 1998 which recognizes workplace-based programs as a potent tool in addressing HIV/AIDS as an international pandemic problem, this company policy is hereby issued for the information and guidance of the employees in the diagnosis, treatment and prevention of HIV/AIDS in the workplace.

This policy is also aimed at addressing the stigma attached to HIV/AIDS and ensures that the workers’ right against discrimination and confidentiality is maintained.

I. IMPLEMENTING STRUCTURE

ProThrowbacks HIV/AIDS Program shall be managed by its health and safety committee consists of representatives from the different divisions and departments.

II. BASIC INFORMATION ON HIV/AIDS

What is HIV/AIDS?

It is a disease caused by a virus called HIV (Human Immunodeficiency Virus). This virus slowly weakens a person’s ability to fight off other diseases by attaching itself to and destroying important cells that control and support the human immune system.

How HIV/AIDS is transmitted?

- Unprotected sex with an HIV infected person;

- From an infected mother to her child ( during pregnancy, at birth through breast feeding);

- Intravenous drug use with contaminated needles;

- Transfusion with infected blood and blood products; and

- Unsafe, unprotected contact with infected blood and bleeding wounds of an infected person.

No. However, there are antiretroviral drug combinations that are available when properly used, result in prolonged survival of people with HIV. Holistic care of people living with HIV-AIDS and comprehensive treatment of opportunistic infections also dramatically improve quality of life.

III. COVERAGE

This Program shall apply to all employees regardless of their employment status.

IV. GUIDELINES

A. Preventive Strategies

- Conduct of HIV-AIDS Education.-

- Who will conduct?

- How will it be conducted?

2. Screening, Diagnosis, Treatment and Referral to Health Care Services

- Screening for HIV as a prerequisite to employment is not mandatory.

- ProThrowbacks shall establish a referral system and provide access to diagnostic and treatment services for its workers. Referral to Social Hygiene Clinics of LGU for HIV screening shall be facilitated by the company’s medical clinic staff.

- ProThrowbacks shall likewise facilitate access to livelihood assistance for the affected employee and his/her families, being offered by other government agencies.

- Non-discriminatory Policy and Practices

- Discrimination in any form from pre-employment to post- employment, including hiring, promotion or assignment, termination of employment based on the actual, perceived or suspected HIV status of an individual is prohibited.

- Workplace management of sick employees shall not differ from that of any other illness.

- Discriminatory act done by an officer or an employee against their

- Confidentiality/Non-Disclosure Policy

- Access to personal data relating to a worker’s HIV status shall be bound by the rules of confidentiality consistent with provisions of R.A. 8504 and the ILO Code of Practice.

- Job applicants and workers shall not be compelled to disclose their HIV/AIDS status and other related medical information.

- Co-employees shall not be obliged to reveal any personal information relating to the HIV/AIDS status of fellow workers.

- The company shall take measures to reasonably accommodate employees with AIDS related illnesses.

- Agreements made between the company and employee’s representatives shall reflect measures that will support workers with HIV/AIDS through flexible leave arrangements, rescheduling of working time and arrangement for return to work.

A. Employer’s Responsibilities

- The Company, together with employees/ labor organizations, company focal personnel for human resources, safety and health personnel shall develop, implement, monitor and evaluate the workplace policy and program on HIV/AIDS.

- Ensure non-discriminatory practices in the workplace and that the policy and program adheres to existing legislations and guidelines .

- Ensure confidentiality of the health status of its employees and the access to medical records is limited to authorized personnel.

- ProThrowbacks, through its Human Resources Department, shall see to it that their company policy and program is adequately funded and made known to all employees.

B. Employees’ Responsibilities

1. The employee’s organization shall undertake an active role in educating and training their members on HIV prevention and control. Promote and practice a healthy lifestyle with emphasis on avoiding high risk behavior and other risk factors that expose workers to increased risk of HIV infection.

2. Employees shall practice non-discriminatory acts against co-employees.

- Employees and their organization shall not have access to personnel data relating to a worker’s HIV status.

V. IMPLEMENTATION AND MONITORING

The Safety and Health Committee or its counterpart shall periodically monitor and evaluate the implementation of this Policy and Program.

VI. EFFECTIVITY

This Policy shall take place effective immediately and shall be made known to every employee.

Original Signed

MRS. ROSEN C. HARVISON, OWNER

Original Signed

RUTCHE MAE NOBLE, V.P. OPERATIONS

First aid practices and ‘universal precautions’ within the workplace should be highlighted

This Policy shall take place effective immediately and shall be made known to every employee.

In effect Feb 6, 2015.

Policy and Prevention of Hepatitis B

WORKPLACE POLICY AND PROGRAM ON HEPATITIS B

ProThrowbacks is committed to conform to the established standards assurance of customer satisfaction, protection of our environment and health and safety in the workplaces.

The company promotes and ensures a healthy environment through its various health programs to safeguard its employees. And as part of the company’s compliance to DOLE Department Advisory No. 05, Series of 2010 (Guidelines for the Implementation of a Workplace Policy and Program on Hepatitis B), this Program has been developed. This program is aimed to address the stigma attached to hepatitis B and to ensure that the employees’ right against discrimination and confidentiality is maintained.

This guideline is formulated for everybody’s information and reference for the diagnosis, treatment, and prevention of Hepatitis B. This will inform the employees of their role as well as the company in dealing with Hepatitis B. A healthy environment encompasses a good working relationship and great output for continuous business growth.

I. Implementing Structure

The ProThrowbacks Hepatitis B workplace policy and program shall be managed by its health and safety committee. Each division or department of the Company shall be duly represented.

II. Guidelines

A. Education

1. Coverage. All employees regardless of employment status may avail of hepatitis B education services for free;

2. Hepatitis B shall be conducted through distribution and posting of IEC materials and counselling and/ or lectures; and

3. Hepatitis B education shall be spearheaded by the Medical City or Strtsenberg Medical Clinic in close coordination with the health and safety committee.

B. Preventive Strategies

1. All employees are encouraged to be immunized against Hepatitis B after securing clearance from their physician.

2. Workplace sanitation and proper waste management and disposal shall be monitored by the health and safety committee on a regular basis.

3. Personal protective equipment shall be made available at all times for all employees; and

4. Employees will be given training and information on adherence to standards or universal precautions in the workplace.

III. Social Policy

2. Workplace management of sick employees shall not differ from that of any other illness. Persons with Hepatitis B related illnesses may work for as long as they are medically fit to work.

2. Through agreements made between management and employees’ representative, measures to support employees with Hepatitis B are encouraged to work through flexible leave arrangements, rescheduling of working time and arrangement for return to work.

2. Adherence to the guidelines for healthcare providers on the evaluation of Hepatitis B positive employees is highly encouraged.

3. Screening for Hepatitis B as a prerequisite to employment shall not be mandatory.

IV. Roles and Responsibilities of Employers and Employees

A. Employer’s Responsibilities

1. Management, together with employees’ organizations, company focal personnel for human resources, and safety and health personnel shall develop, implement, monitor and evaluate the workplace policy and program on Hepatitis B.

2. The Health and Safety Committee shall ensure that their company policy and program is adequately funded and made known to all employees.

3. The Human Resources Department shall ensure that their policy and program adheres to existing legislations and guidelines, including provisions on leaves, benefits and insurance.

4. Management shall provide information, education and training on Hepatitis B for its workforce consistent with the standardized basic information package developed by the Hepatitis B TWG; if not available within the establishment, then provide access to information.

5. The company shall ensure non-discriminatory practices in the workplace.

6. The management together with the company focal personnel for human resources and safety and health shall provide appropriate personal protective equipment to prevent Hepatitis B exposure, especially for employees exposed to potentially contaminated blood or body fluid.

7. The Health and Safety Committee, together with the employees’ organizations shall jointly review the policy and program for effectiveness and continue to improve these by networking with government and organizations promoting Hepatitis B prevention.

8. ProThrowbacks shall ensure confidentiality of the health status of its employees, including those with Hepatitis B.

9. The human resources shall ensure that access to medical records is limited to authorized personnel.

B. Employees Responsibilities

1. The employees’ organization is required to undertake an active role in educating and training their members on Hepatitis B prevention and control. The IEC program must also aim at promoting and practicing a healthy lifestyle with emphasis on avoiding high risk behavior and other risk factors that expose employees to increased risk of Hepatitis B infection, consistent with the standardized basic information package developed by the Hepatitis B TWG.

2. Employees shall practice non-discriminatory acts against co-employees on the ground of Hepatitis B status.

3. Employees and their organizations shall not have access to personnel data relating to an employee’s Hepatitis B status. The rules of confidentiality shall apply in carrying out union and organization functions.

4. Employees shall comply with the universal precaution and the preventive measures.

5. Employees with Hepatitis B may inform the health care provider or the company physician on their Hepatitis B status, that is, if their work activities may increase the risk of Hepatitis B infection and transmission or put the Hepatitis B positive at risk for aggravation.

V. IMPLEMENTATION AND MONITORING

Within the establishment, the implementation of the policy and program shall be monitored and evaluated periodically. The safety and health committee or its counterpart shall be tasked for this purpose.

HOW CAN HEPATITIS B BE PREVENTED IN THE WORKPLACE? IMMUNIZATION AGAINST HEPATITIS B The hepatitis B vaccine is over 90 per cent effective in preventing HBV infection. The vaccine is safe and has no serious side effects since it is made from synthetic material and not from human tissue. To be protected, you need three doses of the vaccine. You get the second dose one month after the first and the third five months later. Studies have shown that you do not need a booster shot of the vaccine after getting the initial three dose vaccine schedule.

Other precautions: Wash hands before and after all contact with patients or their blood/body fluids. Wash all body surfaces exposed to blood or body fluids with soap and water as soon as possible after contact. Avoid recapping used needles. Dispose of used needles and other contaminated sharp instruments and tools in puncture-resistant containers. Place materials soiled with blood or body fluids in leak-proof, appropriately labeled waste bags/containers.

REPORTING AND FOLLOW-UP OF EXPOSURE Workers must report all incidents of exposure to contaminated or potentially contaminated blood or body fluids to their supervisors, their employee health departments and their physicians. Employers must keep appropriate records of workers' exposures.

WHAT SHOULD BE DONE IF A WORKER IS EXPOSED TO HBV? The following initial measures should be taken: Allow any wound to bleed freely. Cleanse with soap and water. Apply an appropriate antiseptic to any wound. Medical advice should be sought for instituting the following measures and for follow-up: In the case of a puncture wound, assess the person's tetanus immunization status and provide anti-tetanus toxoid as required. If the exposed worker has not received the hepatitis B vaccine, she/he should be given the first dose of the vaccine, and arrangement should be made for the second and third doses. Depending on the circumstances, it may be appropriate for the person to receive Hepatitis B Immune Globulin (HBIG). As well as a full course of the vaccine. HBIG is a preparation containing antibodies specifically designed to attack HBV and should be given within 48 hours of exposure.

IS THERE ANY TREATMENT FOR HEPATTIS B? There is no specific treatment for hepatitis B. Immunization is the most effective tool in preventing the occurrence of the disease. Hospitalization may be required for some patients.

This Policy shall take place effective immediately and shall be made known to every employee.

In effect Feb 6, 2015. Use caution at all times when anyone cuts themselves. Avoid contact as much as possible.

VI. EFFECTIVITY

This Policy shall take effect immediately and shall be made known to all employees.

Original Signed

MRS. ROSEN C. HARVISON, OWNER

Original Signed

RUTCHE MAE NOBLE, V.P. OPERATIONS

WORKPLACE POLICY AND PROGRAM ON HEPATITIS B

ProThrowbacks is committed to conform to the established standards assurance of customer satisfaction, protection of our environment and health and safety in the workplaces.

The company promotes and ensures a healthy environment through its various health programs to safeguard its employees. And as part of the company’s compliance to DOLE Department Advisory No. 05, Series of 2010 (Guidelines for the Implementation of a Workplace Policy and Program on Hepatitis B), this Program has been developed. This program is aimed to address the stigma attached to hepatitis B and to ensure that the employees’ right against discrimination and confidentiality is maintained.

This guideline is formulated for everybody’s information and reference for the diagnosis, treatment, and prevention of Hepatitis B. This will inform the employees of their role as well as the company in dealing with Hepatitis B. A healthy environment encompasses a good working relationship and great output for continuous business growth.

I. Implementing Structure

The ProThrowbacks Hepatitis B workplace policy and program shall be managed by its health and safety committee. Each division or department of the Company shall be duly represented.

II. Guidelines

A. Education

1. Coverage. All employees regardless of employment status may avail of hepatitis B education services for free;

2. Hepatitis B shall be conducted through distribution and posting of IEC materials and counselling and/ or lectures; and

3. Hepatitis B education shall be spearheaded by the Medical City or Strtsenberg Medical Clinic in close coordination with the health and safety committee.

B. Preventive Strategies

1. All employees are encouraged to be immunized against Hepatitis B after securing clearance from their physician.

2. Workplace sanitation and proper waste management and disposal shall be monitored by the health and safety committee on a regular basis.

3. Personal protective equipment shall be made available at all times for all employees; and

4. Employees will be given training and information on adherence to standards or universal precautions in the workplace.

III. Social Policy

- Non discriminatory Policy and Practices

2. Workplace management of sick employees shall not differ from that of any other illness. Persons with Hepatitis B related illnesses may work for as long as they are medically fit to work.

- Confidentiality

- Work-Accommodation and Arrangement

2. Through agreements made between management and employees’ representative, measures to support employees with Hepatitis B are encouraged to work through flexible leave arrangements, rescheduling of working time and arrangement for return to work.

- Screening, Diagnosis, Treatment and Referral to Health Care Services

2. Adherence to the guidelines for healthcare providers on the evaluation of Hepatitis B positive employees is highly encouraged.

3. Screening for Hepatitis B as a prerequisite to employment shall not be mandatory.

- Compensation

IV. Roles and Responsibilities of Employers and Employees

A. Employer’s Responsibilities

1. Management, together with employees’ organizations, company focal personnel for human resources, and safety and health personnel shall develop, implement, monitor and evaluate the workplace policy and program on Hepatitis B.

2. The Health and Safety Committee shall ensure that their company policy and program is adequately funded and made known to all employees.

3. The Human Resources Department shall ensure that their policy and program adheres to existing legislations and guidelines, including provisions on leaves, benefits and insurance.

4. Management shall provide information, education and training on Hepatitis B for its workforce consistent with the standardized basic information package developed by the Hepatitis B TWG; if not available within the establishment, then provide access to information.

5. The company shall ensure non-discriminatory practices in the workplace.

6. The management together with the company focal personnel for human resources and safety and health shall provide appropriate personal protective equipment to prevent Hepatitis B exposure, especially for employees exposed to potentially contaminated blood or body fluid.

7. The Health and Safety Committee, together with the employees’ organizations shall jointly review the policy and program for effectiveness and continue to improve these by networking with government and organizations promoting Hepatitis B prevention.

8. ProThrowbacks shall ensure confidentiality of the health status of its employees, including those with Hepatitis B.

9. The human resources shall ensure that access to medical records is limited to authorized personnel.

B. Employees Responsibilities

1. The employees’ organization is required to undertake an active role in educating and training their members on Hepatitis B prevention and control. The IEC program must also aim at promoting and practicing a healthy lifestyle with emphasis on avoiding high risk behavior and other risk factors that expose employees to increased risk of Hepatitis B infection, consistent with the standardized basic information package developed by the Hepatitis B TWG.

2. Employees shall practice non-discriminatory acts against co-employees on the ground of Hepatitis B status.

3. Employees and their organizations shall not have access to personnel data relating to an employee’s Hepatitis B status. The rules of confidentiality shall apply in carrying out union and organization functions.

4. Employees shall comply with the universal precaution and the preventive measures.

5. Employees with Hepatitis B may inform the health care provider or the company physician on their Hepatitis B status, that is, if their work activities may increase the risk of Hepatitis B infection and transmission or put the Hepatitis B positive at risk for aggravation.

V. IMPLEMENTATION AND MONITORING

Within the establishment, the implementation of the policy and program shall be monitored and evaluated periodically. The safety and health committee or its counterpart shall be tasked for this purpose.

HOW CAN HEPATITIS B BE PREVENTED IN THE WORKPLACE? IMMUNIZATION AGAINST HEPATITIS B The hepatitis B vaccine is over 90 per cent effective in preventing HBV infection. The vaccine is safe and has no serious side effects since it is made from synthetic material and not from human tissue. To be protected, you need three doses of the vaccine. You get the second dose one month after the first and the third five months later. Studies have shown that you do not need a booster shot of the vaccine after getting the initial three dose vaccine schedule.

Other precautions: Wash hands before and after all contact with patients or their blood/body fluids. Wash all body surfaces exposed to blood or body fluids with soap and water as soon as possible after contact. Avoid recapping used needles. Dispose of used needles and other contaminated sharp instruments and tools in puncture-resistant containers. Place materials soiled with blood or body fluids in leak-proof, appropriately labeled waste bags/containers.

REPORTING AND FOLLOW-UP OF EXPOSURE Workers must report all incidents of exposure to contaminated or potentially contaminated blood or body fluids to their supervisors, their employee health departments and their physicians. Employers must keep appropriate records of workers' exposures.

WHAT SHOULD BE DONE IF A WORKER IS EXPOSED TO HBV? The following initial measures should be taken: Allow any wound to bleed freely. Cleanse with soap and water. Apply an appropriate antiseptic to any wound. Medical advice should be sought for instituting the following measures and for follow-up: In the case of a puncture wound, assess the person's tetanus immunization status and provide anti-tetanus toxoid as required. If the exposed worker has not received the hepatitis B vaccine, she/he should be given the first dose of the vaccine, and arrangement should be made for the second and third doses. Depending on the circumstances, it may be appropriate for the person to receive Hepatitis B Immune Globulin (HBIG). As well as a full course of the vaccine. HBIG is a preparation containing antibodies specifically designed to attack HBV and should be given within 48 hours of exposure.

IS THERE ANY TREATMENT FOR HEPATTIS B? There is no specific treatment for hepatitis B. Immunization is the most effective tool in preventing the occurrence of the disease. Hospitalization may be required for some patients.

This Policy shall take place effective immediately and shall be made known to every employee.

In effect Feb 6, 2015. Use caution at all times when anyone cuts themselves. Avoid contact as much as possible.

VI. EFFECTIVITY

This Policy shall take effect immediately and shall be made known to all employees.

Original Signed

MRS. ROSEN C. HARVISON, OWNER

Original Signed

RUTCHE MAE NOBLE, V.P. OPERATIONS

ProThrowbacks Policy and Program on Tuberculosis Prevention and Control in the Workplace

ProThrowbacks recognizes that while 80% of Tuberculosis (TB) cases belong to the economically productive individuals, it is also treatable and its spread can be curtailed if proper control measures will be implemented. As such, this TB Policy and Program is hereby issued for the information and guidance of the employees.

PURPOSE:

To address the stigma attached to TB and to ensure that the worker’s right against discrimination, brought by the disease, is protected.

To facilitate free access to anti-TB medicines of affected employees through referrals.

I. IMPLEMENTING STRUCTURE

ProThrowbacks TB Program shall be managed by its health and safety committee consists of representatives from the different divisions and departments.

II. COVERAGE

This Program shall apply to all employees regardless of their employment status.

III. GUIDELINES

A. Preventive Strategies

1. Conduct of Tuberculosis (TB) Advocacy, Training and Education

a. TB education shall be conducted by the Medical City or Strotsenberg Medical Clinic in close coordination with the health and safety committee, through distribution and posting of IEC materials and counseling and/ or lectures.

b. Engineering measures such as improvement of ventilation, provision for adequate sanitary facilities and observance of standard for space requirement (avoidance of overcrowding) shall be implemented.

2. Screening, Diagnosis, Treatment and Referral to Health Care Services

a. ProThrowbacks shall establish a referral system and provide access to diagnostic and treatment services for its employees. The company shall make arrangements with the nearest Direct Observed Treatment (DOT) facility.

b. The company’s adherence to the DOTS guidelines on the diagnosis and treatment is highly encouraged.

B. MEDICAL MANAGEMENT

- ProThrowbacks shall adopt the DOTS strategy in the management of workers with tuberculosis. TB case finding, case holding and Reporting and Recording shall be in accordance with the Comprehensive Unified Policy (CUP) and the National Tuberculosis Control Program.

C. SOCIAL POLICY

1. Non-discriminatory Policy and Practices

a. There shall be no discrimination of any form against employees from pre to post employment, including hiring, promotion, or assignment, on account of their TB status. (ILO C111)

b. Workplace management of sick employees shall not differ from that of any other illness. Persons with TB related illnesses should be able to work for as long as medically fit.

- Work-Accommodation and Arrangement

b. The employee may be allowed to return to work with reasonable working arrangements as determined by the Company Health Care provider and/or the DOTS provider.

D. COMPENSATION

ProThrowbacks shall provide access to Social Security System and Employees Compensation benefits under PD 626 to an employee who acquired TB infection in the performance of his/her duty.

V. ROLES AND RESPONSIBILITIES OF EMPLOYERS AND EMPLOYEES

A. Employer’s Responsibilities

1. ProThrowbacks, together with workers/ labor organizations, company focal personnel for human resources, safety and health personnel shall develop, implement, monitor and evaluate the workplace policy and program on TB.

- Provide information, education and training on TB prevention for its workforce.

- Ensure non-discriminatory practices in the workplace.

- Ensure confidentiality of the health status of its employees and the access to medical records is limited to authorized personnel.

- The Employer, through its Human Resources Department, shall see to it that their company policy and program is adequately funded and made known to all employees.

- The Health and Safety Committee, together with employees/ labor organizations shall jointly review the policy and program and continue to improve these by networking with government and organizations promoting TB prevention.

1. The employee’s organization is required to undertake an active role in educating and training their members on TB prevention and control.

2. Employees shall practice non-discriminatory acts against co-workers.

3. Employees and their organization shall not have access to personnel

data relating to a worker’s TB status.

4. Employees shall comply with universal precaution and the preventive measures.

V. IMPLEMENTATION AND MONITORING

The Safety and Health Committee or its counterpart shall periodically monitor and evaluate the implementation of this Policy and Program.

VI. EFFECTIVITY

This Policy shall take place effective immediately and shall be made known to every employee.

Original Signed

MRS. ROSEN C. HARVISON, OWNER

Original Signed

RUTCHE MAE NOBLE, V.P. OPERATIONS

In effect Feb 6, 2015

PROTHROWBACKS DRESS CODE

Pure Gold does not allow the use of personal communication devices during working hours as it may present a distraction to employees and customers. ProThrowbacks employees have been given limited access only when it is necessary to contact the office or other ProThrowbacks personnel regarding a business matter. ProThrowbacks reserves the right to do random checks of text messages from employees cell phones outbox to ensure compliance of this rule.

Think family business and safety before dressing and coming to work!

Ensure close-toed shoes are worn at all time. No filp flop or sandals!

Please ensure to wear our ProThrowbacks shirt at work.

No excessive jewelry or body piercing is allowed at any time during working hours.